Gift Card Tax in Norway: What You Need to Know

by Nanna Høeg Tingleff

February 27, 2024

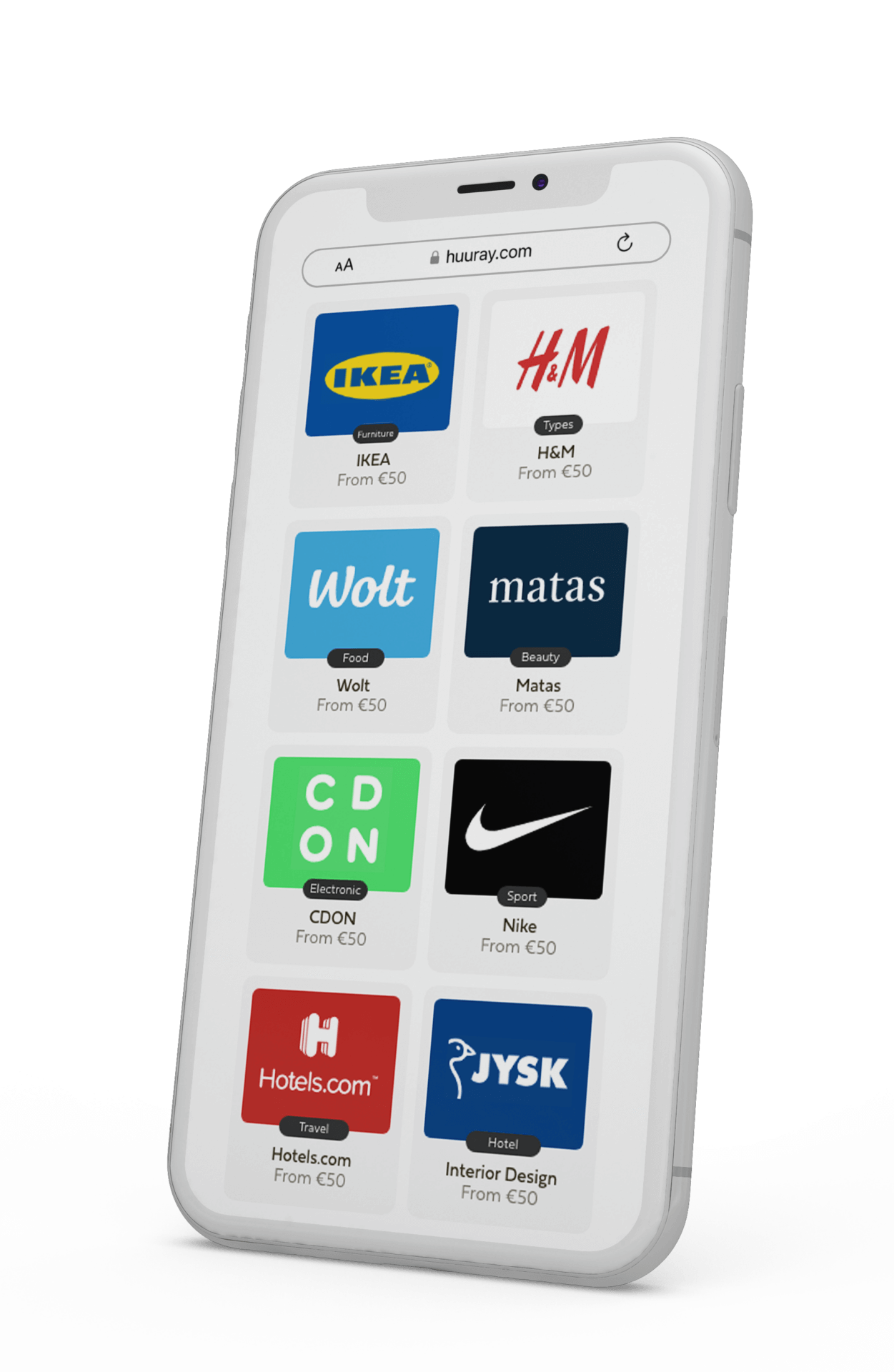

Suppose your business operates in Norway and provides gift cards as rewards or incentives for employees. In that case, it is crucial to have a clear understanding of the taxation regulations that apply to them. Navigating the complexities of gift card taxation in Norway can be challenging, but we are here to provide clarity and simplify the process.

Jump to section

Gift card and gift tax in Norway

In Norway, companies have the opportunity to express appreciation to their employees through gifts, thanks to favorable tax treatment, subject to certain regulations. Let’s break down the details:

- Tax Exemption Limit:

- Companies can provide gifts to employees without triggering tax liability if the value remains below 5,000 NOK per employee per year.

- Cash gifts are not included in this exemption. However, gift cards without cash redemption options are eligible.

- Tax-Exempt Traditional Gifts:

- Traditional gifts like flowers, chocolates, or a bottle of wine are also considered tax-exempt.

- These gifts are allowed regardless of whether other tax-free gifts are given on separate occasions throughout the year.

- Acknowledging Special Occasions:

- Norway recognizes the importance of marking special milestones and occasions in an employee’s life.

- Whether it’s commemorating years of service, significant birthdays, weddings, or anniversaries, companies have flexibility in presenting gifts without tax implications.

These regulations aim to foster a culture of appreciation and recognition within workplaces across Norway. By providing this tax relief, companies can incentivize employee morale, strengthen relationships, and cultivate a positive work environment.

Source: NHO

Related: Gift Card Taxation In Ireland: A Business Guide

Special occasions

When it comes to certain occasions like weddings, retirements, resignations, and birthdays, there are specific rules and exceptions in place with varying amounts.

Length of employment:

If an employee has been with the company for at least 20 years, a gift of up to 8000 NOK can be given. Furthermore, this rule applies every tenth year after that.

Weddings, retirements, resignations, and birthdays:

For these occasions, there is the same monetary amount limit of 4000 NOK. However, there are some special rules. This limit applies if an employee leaves the company after having worked there for at least 10 years.

Moreover, when it comes to birthdays, only milestone ages such as 50, 60, 70, or 80 years old are considered. For milestone birthdays beyond these, the general gift limit of 5000 NOK applies.

Company Anniversary:

If the company has reached the milestone of 25 years in operation, or any multiple of 25 years, a gift valued at up to 4000 NOK can be provided

Send yourself a gift card

Why are gift card tax laws important?

Understanding gift card taxation laws is important for businesses operating in Norway for several reasons:

- Compliance: By being aware of the taxation regulations surrounding gift cards, businesses can ensure they are in compliance with the law and avoid any potential penalties or legal issues.

- Accurate Financial Reporting: Knowing how gift cards are taxed allows businesses to accurately report their financial transactions and maintain transparent records for tax purposes.

- Cost Management: Understanding the tax implications of gift cards helps businesses effectively manage their costs and budget for any tax liabilities associated with these incentives.

- Employee Compensation: Gift cards are often used as rewards or incentives for employees. Knowing the tax rules ensures that businesses can properly account for these benefits and communicate the tax implications to their employees.

- Strategic Decision Making: Awareness of gift card taxation laws allows businesses to make informed decisions regarding their rewards and incentive programs. They can evaluate the tax implications and consider alternative options if necessary.

By staying informed about gift card taxation laws, businesses can navigate the complexities of taxation and ensure compliance while effectively managing their rewards and incentive programs.

Tips and tricks for gift card tax in Norway

In Norway, gift cards are subject to taxation rules, and understanding these regulations is crucial to avoid potential penalties or misunderstandings. Here are some tips to navigate gift card taxation in Norway:

- Understand the Taxation Rules: In Norway, gift cards are considered taxable income if they are given to employees as a form of remuneration. This means that gift cards provided by employers to their employees are subject to taxation.

- Reportable Income: If you receive gift cards from your employer, the value of these cards should be reported as taxable income on your annual tax return. The value of the gift card is typically considered part of your salary or compensation package.

- Keep Records: It’s essential to keep accurate records of any gift cards received, including their value and the purpose for which they were given. This documentation will help you accurately report your income and ensure compliance with tax laws.

- Consult a Tax Professional: If you’re unsure about how gift cards should be treated for tax purposes or if you have complex tax situations, it’s advisable to consult a tax professional. They can provide personalized advice based on your specific circumstances and ensure that you comply with all relevant tax laws.

- Employer Obligations: Employers have obligations to report and withhold taxes on any gift cards provided to employees. They should ensure that the appropriate taxes are deducted and reported to the tax authorities by Norwegian tax laws.

- Gift Cards as Gifts: If gift cards are given to employees as a gift, rather than as part of their compensation package, they may not be subject to taxation. However, it’s essential to distinguish between gifts and compensation to avoid potential tax liabilities.

- Stay Informed: Tax laws and regulations can change over time, so it’s essential to stay informed about any updates or changes to gift card taxation rules in Norway. This will help you ensure compliance and avoid any potential issues with the tax authorities.

By understanding the rules of Gift card tax in Norway and following these tips, individuals and employers can navigate gift card taxation effectively and avoid any potential tax liabilities or penalties.

Case studies to illustrate how Gift Card Tax In Norway works in different scenarios

Gift Card Taxation Case Study:

- Situation: A company in Norway wants to reward its employees for their hard work throughout the year and decides to give each employee a gift card worth 4,000 NOK as a Christmas bonus.

- Tax Implication: The gift card amount falls within the tax-exempt threshold of 5,000 NOK per employee per year. Therefore, the employees won’t face any tax liabilities on these gift cards.

- Outcome: Employees can enjoy their Christmas bonus without worrying about taxation, contributing positively to their morale and motivation.

Birthday Gift Taxation Case Study:

- Situation: An employee, Lena, celebrates her 50th birthday. As per company policy, milestone birthdays such as this warrant a special gift. The company decides to gift Lena a watch worth 4,000 NOK.

- Tax Implication: Gifts given to employees on milestone birthdays like 50, 60, 70, or 80 years old are exempt from taxation up to the limit of 5,000 NOK.

- Outcome: Lena’s birthday gift is within the exempt limit, so she won’t be subject to any gift tax on the watch she received from her employer.

Long-Term Employment Recognition Case Study:

- Situation: Anders has been with his company for 25 years, marking a significant milestone in his career. To commemorate this achievement, the company decides to gift him a plaque and a dinner voucher worth 8,000 NOK.

- Tax Implication: Employees who have been with the company for at least 20 years are eligible for gifts up to 8,000 NOK.

- Outcome: Anders’ gift falls within the permissible limit for employees with 20 or more years of service, making it tax-free and a meaningful gesture of appreciation from his employer.

Company Anniversary Gift Taxation Case Study:

- Situation: A company in Norway celebrates its 25th anniversary since its inception. As a token of appreciation, the company decides to gift each employee a customized souvenir worth 4,000 NOK.

- Tax Implication: On company anniversaries such as this, gifts valued at up to 4,000 NOK per employee are tax-exempt.

- Outcome: Employees receive their commemorative gifts without any tax implications, fostering a sense of pride and belonging within the company on this special occasion.

Gift Card Tax in Norway – Key points

- Gift cards can be considered tax-exempt if the value remains below 5,000 NOK per employee per year.

- Cash gifts are not eligible for tax exemption, but gift cards without cash redemption options can be exempt.

- Traditional gifts like flowers, chocolates, and wine are also tax-exempt in Norway.

- Special occasions like weddings, retirements, resignations, and milestone birthdays have specific rules and exceptions.

- Length of employment and company anniversaries can also determine the allowable gift value.

Conclusion

In conclusion, understanding the gift card tax regulations in Norway is not only important but also a duty for companies utilizing rewards and incentives across departments. It is crucial for businesses to be well-informed about the yearly amount limit for tax-free gift cards and to ensure compliance with the tax regulations.

By accurately reporting gift card transactions in their tax returns, companies can not only avoid potential penalties but also maintain a smooth operation and demonstrate their commitment to responsible financial practices. Taking these steps will not only help businesses stay on the right side of the law but also foster trust and credibility with both employees and the tax authorities.

Let’s have a chat

FAQ

Length of employment and company anniversaries can determine the allowable gift value, with specific rules for each milestone.

Remember to consult with a tax professional for personalized advice and to stay informed about any updates or changes to gift card taxation laws in Norway.

Yes, special occasions like weddings, retirements, resignations, and milestone birthdays have specific rules and exceptions that determine the allowable gift value.

Yes, traditional gifts such as flowers, chocolates, and wine are tax-exempt in Norway.

No, cash gifts are not eligible for tax exemption in Norway. However, gift cards without cash redemption options can be exempt.

The yearly amount limit for tax-exempt gift cards in Norway is 5,000 NOK per employee per year.