Gift Cards vs Cash: Which is the Better Gift Option?

by S.Losina

August 21, 2023

When it comes to giving gifts, the age-old question persists: Should you give a gift card or cash? While some may argue that cash is the ultimate gift, recent studies have shown a shift in preferences. It seems that gift cards are becoming the go-to choice for many gift-givers. But why is this? In this article, we will explore the benefits of both gift cards and cash and ultimately determine which option is the better choice for your next gifting occasion. So, whether you’re looking to surprise a loved one on their birthday or show appreciation to colleagues or employees, read on to find out which option will leave a lasting impression.

Table of Contents

Why the dilemma, Gift Cards vs Cash?

Ah, the Gift Cards vs Cash predicament—a classic challenge in the world of gift-giving! So, let’s dive in together and explore the delightful complexities of this never-ending question. Striking that perfect balance between practicality and sentimental value takes center stage when deciding between these two options. After all, we’re aiming for a choice that brings both joy and usefulness into the equation!

Gift Cards

- Gift cards have become increasingly popular in recent years and for good reason. The Global Digital Gift Card Market size is expected to reach $724.3 billion by 2028, rising at a market growth of 14.2% CAGR during the forecast period. Gift cards offer a wide range of benefits that cash simply cannot match. One of the main advantages of gift cards is the freedom of choice and customization they provide. With a gift card, you are giving the recipient the freedom to choose something they truly want or need. Whether it’s a shopping spree at their favorite clothing store or a relaxing massage at a local spa, gift cards allow the receiver to treat themselves to something special.

- Additionally, gift cards are more memorable and thoughtful than cash. By selecting a gift card that aligns with the recipient’s interests and preferences, you are showing that you put thought and effort into your gift. This personal touch can make all the difference and create a lasting impression.

- Furthermore, gift cards are incredibly convenient. They eliminate the need for the recipient to go to the bank to deposit cash or worry about carrying it around. With a gift card, the receiver can simply swipe or enter the code and enjoy their purchase hassle-free. This convenience factor makes gift cards an ideal choice for busy individuals who appreciate simplicity and ease.

- Lastly, gift cards can serve as rewards or incentives for employee performance and accomplishments. While cash may seem like the obvious choice, there are several reasons why opting for gift cards can be a much better option. By selecting gift cards that align with the employees’ interests or hobbies, you demonstrate that you have taken the time to consider their individual preferences. This level of thoughtfulness not only shows your appreciation but also boosts employee morale and engagement. Giving a gift card to a specific store or experience allows employees to treat themselves to something they truly enjoy, making the reward more meaningful and memorable.

Source: Research and Markets

Cash

While gift cards may be gaining popularity, cash is still a relevant and viable option when it comes to gifting. There are certain situations where cash may be the better choice, depending on the recipient and the occasion.

- One of the key advantages of cash is its versatility. Unlike gift cards, which are limited to specific stores or businesses, cash can be used anywhere. This gives the recipient the freedom to spend the money as they please, whether it’s on a practical necessity or a luxurious treat. Cash allows them to prioritize their own needs and desires, making it a truly personalized gift.

- Another benefit of cash is its immediacy. While gift cards may have expiration dates or require the recipient to spend a certain amount at once, cash can be used whenever and however the recipient sees fit. Whether they choose to save it for a rainy day or splurge on something special, cash allows for flexibility and spontaneity.

- Additionally, cash can be a more practical option for certain individuals. For example, if you are giving a gift to someone who is financially struggling or in need of immediate funds, cash can provide much-needed relief. It can help cover bills, pay for groceries, or address any other pressing financial obligations.

- Lastly, cash can also be seen as a more traditional and sentimental gift. In some cultures and traditions, giving cash symbolizes good luck, prosperity, and blessings. It can be a symbolic gesture of support and well-wishes for the recipient’s future endeavors.

Read also: 17 Thank You Gift ideas That You Don’t Wanna Miss Out On

Pros and Cons

Pros of Gift Cards

- Personalization: Gift cards can be tailored to the recipient’s preferences, showcasing that you’ve put thought into their likes and interests. Whether it’s a gift card to a favorite restaurant or a store that aligns with their hobbies, this personal touch adds a level of consideration that cash might lack.

- Special Occasions: They’re ideal for specific occasions or stores. For instance, a bookstore gift card for a bookworm or a spa gift card for someone who loves relaxation. This specificity adds an element of excitement as the recipient envisions the enjoyable experience they’ll have thanks to your thoughtful gift.

- Prevent Impulsive Spending: One major advantage of gift cards is that they encourage recipients to spend intentionally. When given cash, there’s a chance that it might be used on something unnecessary or impulsive. A gift card, however, directs the recipient’s spending toward a predetermined category, which can lead to more thoughtful purchases.

- Memorability: Gift cards can often be more memorable than cash, as they tie a particular experience or item to the gift. For instance, receiving a gift card for a cooking class might create a lasting memory of a fun learning experience. This memory is less likely to fade compared to using cash for everyday expenses.

- Safety: If lost, gift cards can often be replaced, providing a level of security that cash lacks. While losing a gift card can be disappointing, knowing that it can be recovered lessens the potential impact of misplacing it.

Cons of Gift Card:

- Limited Use: One of the primary downsides of gift cards is their limited use. They’re typically confined to specific stores, restaurants, or services, limiting the recipient’s choices. If the designated store isn’t to the recipient’s liking or not conveniently located, the gift card’s value might go unused.

- Expiry Dates: Many gift cards have expiration dates, which can lead to unused funds if not used in time. This time constraint can create pressure for the recipient to use the card within a specific period, potentially causing them to rush into a purchase they wouldn’t otherwise make.

- Unwanted Choices: There’s a chance the recipient might not be interested in the designated store or service. In such cases, the gift card might end up being regifted or sold, diminishing the thoughtfulness behind the gesture.

- Value Restrictions: Some gift cards might have a minimum purchase requirement or not allow the use of the card for certain items. This can limit the recipient’s ability to fully utilize the card’s value, leading to frustration or disappointment.

Send yourself a gift card

Pros of Cash

- Ultimate Flexibility: Cash can be used anywhere, giving the recipient complete freedom in how they spend it. Unlike gift cards, which restrict the recipient to specific establishments, cash allows them to choose where and how to allocate the funds.

- Practicality: Cash is a universal gift that’s always useful, whether for immediate expenses or saving for future needs. It provides recipients with the flexibility to allocate money based on their current financial situation or goals.

- No Expiry: Unlike gift cards, cash doesn’t come with an expiration date. Recipients can hold onto the cash until they find something they truly want or need, without the pressure of a looming deadline.

- Emergency Use: Cash can be a lifesaver in emergencies or unexpected situations. Having cash on hand provides a sense of security and preparedness, which can be especially valuable in times of need.

Cons of Cash

- Impersonal: Cash can sometimes be seen as a less thoughtful gift, lacking the personal touch that a carefully selected gift card might have. While practical, it might not convey the same level of consideration or effort that a thoughtfully chosen gift card does.

- Risk of Misuse: There’s a possibility that the cash might not be used responsibly or might be spent on trivial items. Without any restrictions, the recipient might be tempted to use the money on something fleeting rather than something meaningful or necessary.

- Lack of Memory: Unlike a gift card tied to a specific experience, cash might not create a lasting memory associated with the gift. The lack of a memorable connection can make the gift feel less significant in the long run.

- Less Special: Cash might not feel as special as receiving a gift card that’s been chosen for a particular interest. The absence of personalization can make the gift seem more like a transaction rather than a heartfelt gesture.

In the end, the choice between gift cards and cash hinges on the recipient’s preferences, the occasion, and the message you wish to communicate. Each option has its own set of merits and drawbacks, so the task lies in selecting the alternative that best matches the recipient’s requirements and your intent. Gift cards present a personalized touch and the possibility of a lasting experience, while cash grants unparalleled adaptability and utility. Taking into account the recipient’s personality, interests, and situation is essential in making your decision.

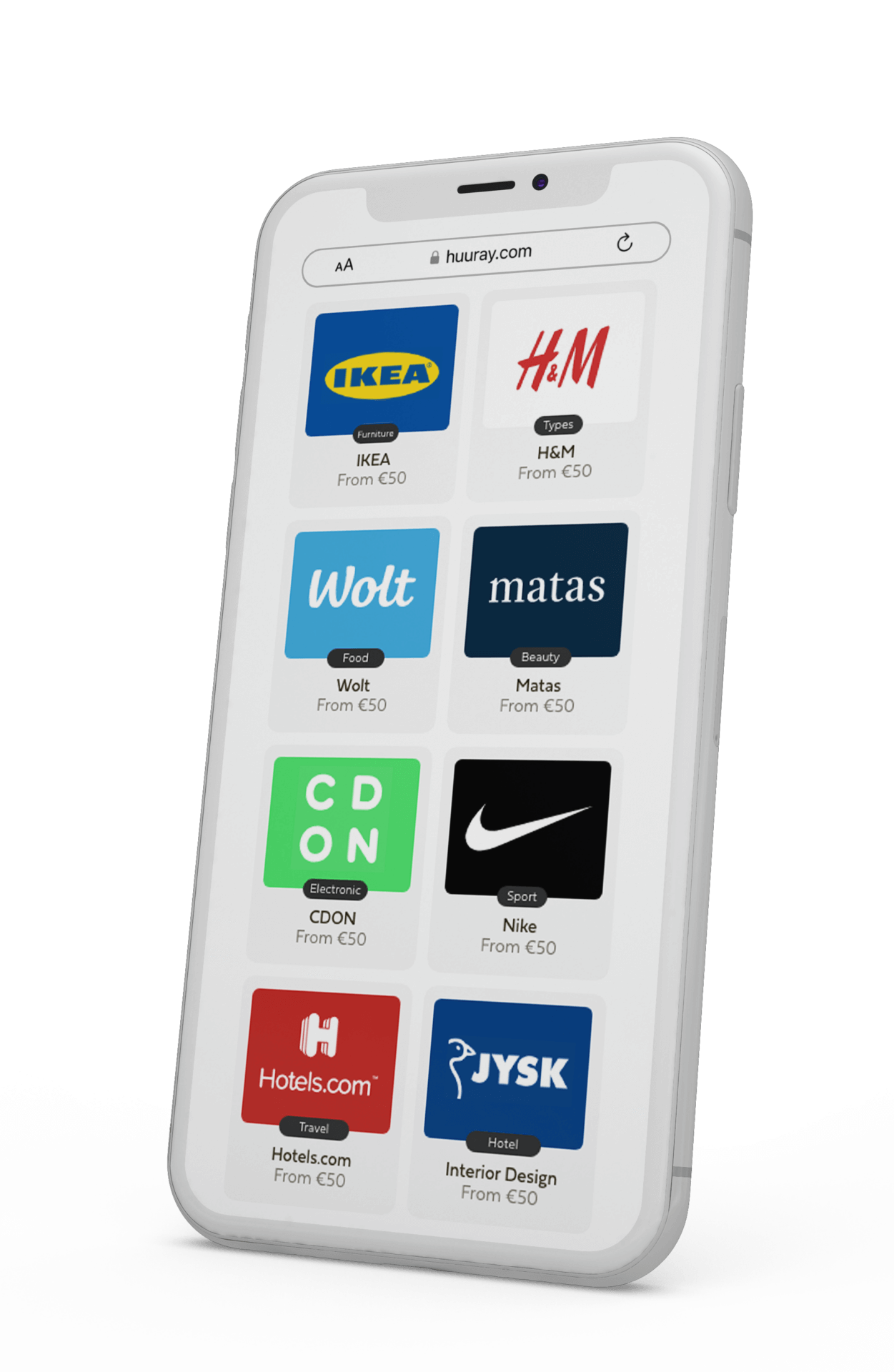

3 of the Most Popular Freedom-of-Choice Gift Cards

When it comes to gift-giving, you want to ensure that your recipient feels special and valued. One way to do this is by giving them the freedom to choose their own gift. This is where freedom-of-choice gift cards come in. These versatile gift cards allow the recipient to select from a wide range of options, ensuring that they get something they truly want or need. Here are three of the most popular freedom-of-choice gift cards that are sure to delight any recipient:

1. Amazon Gift Card:

It’s no surprise that an Amazon gift card is at the top of the list. With Amazon being the largest online retailer in the world, the possibilities are endless. Whether your recipient is a bookworm, a tech enthusiast, a fashionista, or anything in between, they are sure to find something they love on Amazon. From electronics to clothing, home appliances to beauty products, an Amazon gift card gives them access to millions of products. It’s like giving them a virtual shopping spree!

2. Visa Gift Card:

The Visa gift card is another popular freedom-of-choice option. Accepted at millions of locations worldwide, this gift card gives the recipient the freedom to shop wherever they please. Whether they want to treat themselves to a fancy dinner, splurge on a new pair of shoes, or simply stock up on groceries, the Visa gift card allows them to do just that. It’s like giving them the gift of endless possibilities.

3. Starbucks Gift Card:

For the coffee lover in your life, a Starbucks card is the perfect choice. With Starbucks locations on every corner, this gift card allows them to indulge in their favorite caffeinated beverages and tasty treats. From a classic latte to a seasonal pumpkin spice latte, there’s something for everyone at Starbucks. Plus, they can even use the gift card to purchase merchandise like mugs, tumblers, and bags of their favorite coffee blend. It’s like giving them a daily dose of happiness in a cup.

Conclusion

In conclusion, when it comes to the age-old debate of whether to give cash or a gift card, there are valid arguments for both sides. While cash may offer more flexibility and personalization, gift cards provide convenience, versatility, and thoughtfulness. The choice between the two ultimately depends on the recipient’s preferences and circumstances. If you want to show that you’ve put thought into their gift, a gift card can provide a more personalized touch. Conversely, if you aim to grant them the freedom to use the gift as they see fit, cash could be the more appropriate choice

Ultimately, when deciding between a gift card or cash for friends, family, loved ones, or employees, the most important aspect to consider is choosing a gift that not only brings joy but also offers convenience to the recipient.

The decision is yours: will it be gift cards or cash? Your choice!

Let’s have a chat

FAQ

Gift cards are widely accepted at a variety of stores and establishments. Some common types of stores that typically accept gift cards include department stores, clothing retailers, electronic stores, grocery stores, restaurants, and online retailers. Additionally, many specialty shops and boutiques also accept gift cards as a form of payment. With the increasing popularity of gift cards, it is becoming more common for a wide range of stores to offer and accept gift cards as a convenient and versatile gifting option.

Yes, there are potential tax implications when using gift cards. In the cards are generally considered taxable income if they are given as compensation or as part of a promotional program. This means that the recipient may be required to report the value of the gift card as income on their tax return. However, it’s important to note that gift cards given as personal gifts are generally not subject to income tax. As always, it’s best to consult with a tax professional or review the specific tax laws in your jurisdiction to fully understand any potential tax implications associated with gift cards.

The validity period of an international gift card varies depending on the issuer and the specific terms and conditions of the card. Some gift cards have no expiration date, while others may expire after a certain period of time, typically ranging from 1 to 3 years. It’s crucial to read the terms and conditions of each international gift card before purchase to determine the expiration date and any other limitations or restrictions that may apply. Additionally, it’s recommended to use the gift card as soon as possible to avoid any potential issues with card expiration or devaluation.