A Guide to Gift Card Taxation in Sweden for Businesses

by Ummul Qura Danish

February 13, 2024

Gift cards have become a popular choice for both individuals and companies alike. They offer a convenient and flexible gifting solution, allowing recipients to choose their desired items or experiences. For businesses, gift cards provide a valuable tool for rewarding employees and incentivizing customers. In this article, we will explore the taxation regulations in Sweden, specifically focusing on gift cards and how they impact businesses.

Jump to section

What is Gift card taxation in Sweden?

In Sweden, gift cards are not subject to taxation as they are considered real gifts. Since 2004, gifts are not considered taxable income. Therefore, if you receive a gift card from someone, you will not be required to pay income tax on the value of the gift card.

- Tax Exemption: Gift cards are treated as real gifts, not subject to income tax.

- International Considerations: Taxation rules may vary for gifts received from outside Sweden. It’s advisable to consult regarding the tax regulations in the giver’s country.

- Informal Requirements: Courts typically assess if a transfer qualifies as a gift. These requirements include voluntary transfer, no expectation of service or consideration in return, and a clear intention of gifting from the giver.

- Gift Deeds: While there’s no direct limit to the amount one can receive as a gift, having a gift deed (gåvobrev) in place is recommended, stating the money received is a gift with no expectation of services or considerations in return.

- Temporary Tax Breaks: During challenging times, such as in 2020, Sweden implemented temporary tax breaks to support businesses. Gifts to employees up to SEK 1,000 were tax-exempt, encouraging spending and supporting local businesses.

Understanding the tax implications of gift cards in Sweden is essential for both givers and receivers. While gift cards are tax-free, it’s crucial to be aware of any international taxation considerations and informal gift requirements. Keeping abreast of temporary tax breaks can also provide opportunities for tax-efficient gift-giving, benefiting both individuals and businesses alike.

Why are gift card taxation laws important?

Economic Revenue Generation:

- A proper understanding of gift card taxation laws ensures that businesses comply with tax regulations, contributing to the country’s revenue generation.

- By issuing gift cards and accurately reporting their value, businesses participate in the economy and support local commerce.

Enhanced Transparency:

- Compliance with gift card taxation laws fosters transparency in financial transactions between businesses, employees, and customers.

- Transparent reporting of gift card values as taxable income promotes trust and accountability within the business ecosystem.

Equity in Taxation:

- Adherence to gift card taxation laws ensures equitable taxation practices, preventing tax evasion and unfair advantages.

- Equal treatment of all income sources, including gift cards, promotes fairness in the tax system and reduces disparities among taxpayers.

Legal Compliance and Risk Mitigation:

- Understanding and complying with gift card taxation laws mitigate legal risks for businesses, including fines, penalties, and legal disputes.

- Non-compliance with tax regulations can lead to reputational damage and legal liabilities, impacting the long-term sustainability of businesses.

Promotion of Corporate Social Responsibility (CSR):

- Compliance with gift card taxation laws aligns with corporate social responsibility (CSR) initiatives, demonstrating ethical business practices.

- Businesses that adhere to tax regulations contribute positively to society by supporting government programs and public services.

Customer and Employee Trust:

- Transparent taxation practices instill trust among customers and employees, enhancing brand reputation and loyalty.

- Customers and employees are more likely to engage with businesses that demonstrate integrity and accountability in financial matters.

Stimulating Economic Activity:

- By providing tax breaks for gifts to employees, Sweden aims to stimulate economic activity and support local businesses during challenging times.

- Businesses play a crucial role in driving economic growth and job creation, making compliance with tax regulations vital for overall economic prosperity.

Prevention of Tax Evasion and Fraud:

Understanding gift card taxation laws helps prevent tax evasion and fraud, ensuring that all income sources are accurately reported and taxed.

Transparent taxation practices deter fraudulent activities and promote a level playing field for businesses and taxpayers.

Regulations for Gift Card Taxation in Sweden

Background: Previously, the EU lacked consistent VAT provisions for voucher taxation, leading to varying interpretations among member states. Similarly, Sweden didn’t have specific VAT regulations for vouchers until the EU proposed uniform rules.

EU Proposal and Swedish Response: The European Commission suggested common provisions for voucher taxation in the VAT Directive. In response, the Swedish Ministry of Finance proposed aligning the Swedish VAT Act with the EU directive.

Types of Vouchers:

- Single-Purpose Vouchers: All relevant details are known at purchase, with VAT liability occurring upon payment.

- Multiple-Purpose Vouchers: Specific details may be lacking, and VAT liability arises upon delivery of goods or services.

Taxable Base: For single-purpose vouchers, it’s the consideration paid, while for multiple-purpose vouchers, it’s either the consideration paid or the monetary value stated on the voucher.

Impact on Businesses: Sectors like retail and telecommunications are notably affected. Businesses must ensure compliance to prevent potential strains on liquidity.

Expected Benefits: The changes aim to standardize VAT treatment across the EU, providing clarity in voucher taxation to minimize market distortions.

These adjustments seek to simplify VAT regulations, offer clarity to businesses, and cultivate a more competitive market landscape.

Related: Gift Card Taxation In Ireland: A Business Guide

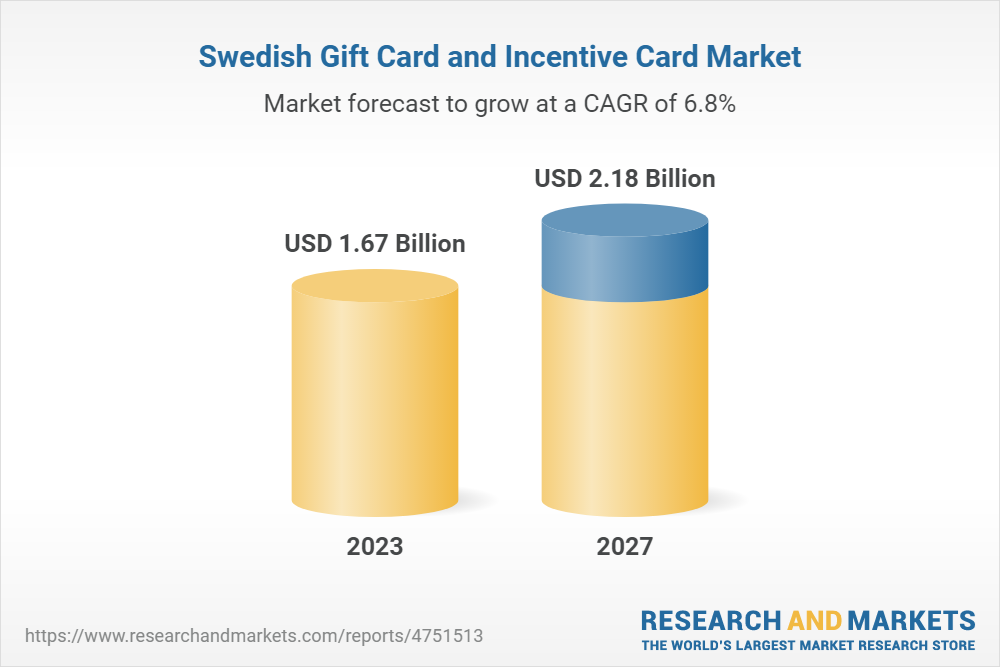

Swedish Gift Card and Incentive Card Market

Source: Swedish gift card and incentive card Market

Send yourself a gift card

Case studies to illustrate how gift card taxation in Sweden works in different scenarios

Case Study 1: Company Rewards Program

Scenario: You’re part of a dynamic multinational company based in Sweden, and hitting those performance targets feels like winning the lottery. As a sweet reward, you receive gift cards through the company’s rewards program. But what’s the tax scoop?

- Income Reporting: The company dishes out the value of those gift cards to employees as income. It’s like a delicious bonus served up on a silver platter!

- Employee Declarations: As an employee, those gift cards are considered taxable income, so you’ll need to declare their value. It’s the responsible thing to do in the tax realm.

- Tax Deductions: But hey, here’s a silver lining: for the company, providing gift cards as employee perks can be deductible. Talk about a win-win for everyone involved!

Case Study 2: Customer Loyalty Program

Scenario: Let’s step into the shoes of a savvy shopper in Sweden. You’re earning points left and right through a retail store’s loyalty program, and those points can be cashed in for gift cards. But what’s the tax tale here?

- Income Reporting: The retail store logs the value of those gift cards as income from their sales. It’s like adding a little extra spice to their financial stew!

- Customer Declarations: Luckily for you, as a customer redeeming those points for gift cards, there’s no need to declare them as taxable income. Time to enjoy those rewards guilt-free!

- Tax Considerations: However, for the retail store, offering loyalty programs may have tax implications, so they’ll need to keep their documentation in check.

Case Study 3: Gift Card Expiration and Unused Balances

Scenario: Last but not least, let’s cozy up to a scenario straight from your favorite local restaurant. They’re selling gift cards with expiration dates and the possibility of leftover balances. How does it all pan out?

- Income Reporting: The restaurant tallies up the value of sold gift cards as income, keeping their financial records savory and sound.

- Expiration Date Dance: If those gift cards come with an expiration date, the restaurant plays by the rules of the validity period. No stale leftovers here!

- Unused Balances: Any kronor left hanging out on those gift cards after a scrumptious meal might need to be reported as income down the line. But fear not—providing gift cards as an employee benefit could be a tax-saving move for the restaurant.

Tips for Gift Card Taxation in Sweden

- Understand the Regulations: Familiarize yourself with the specific regulations surrounding gift card taxation in Sweden. Be aware of the reporting requirements for businesses and the declaration obligations for recipients.

- Keep Accurate Records: Maintain detailed records of the value and issuance of gift cards. This documentation will be crucial for tax purposes and ensuring compliance with the regulations.

- Communicate with Recipients: Inform gift card recipients about their tax obligations. Advise them to declare the value of the gift card as taxable income when required, and provide any necessary documentation to support their declaration.

- Monitor Expiration Dates: If your gift cards have expiration dates, ensure compliance with the regulations regarding validity periods. Keep track of any unused balances and follow the appropriate guidelines for reporting them as income.

- Seek Professional Advice: If you have any doubts or complexities regarding gift card taxation in Sweden, consider consulting with a tax professional or accountant who specializes in Swedish tax regulations. They can provide guidance tailored to your specific situation and help ensure compliance with the rules.

Related: Sweden Gift Card: The Perfect Present for Any Occasion

Motivate your employees with gift cards

Motivating employees is crucial for maintaining a productive and engaged workforce. One effective way to motivate employees is by using gift cards. Here are some reasons why gift cards can be a great tool for employee motivation:

Personalized Rewards:

Gift cards allow you to offer personalized rewards to your employees. By selecting gift cards that align with their interests or preferences, you show that you value and appreciate their individuality.

Flexibility and Choice:

Gift cards provide employees with the flexibility to choose rewards that are meaningful to them. Whether it’s a gift card for their favorite restaurant, online retailer, or spa, employees can select something they truly enjoy.

Tangible Recognition:

Gift cards offer tangible recognition for employees’ hard work and achievements. They can see and feel the reward, boosting morale and motivation.

Incentivizing Performance:

By using gift cards as Employee incentives for meeting performance targets, you can create a sense of healthy competition and drive among your employees. They will be motivated to achieve their goals to earn the rewards.

Team Building and Engagement:

Gift cards can also be used to foster team building and engagement. For example, you can organize team challenges or competitions where employees can earn gift cards together, encouraging collaboration and camaraderie.

Remember, when using gift cards to motivate employees, it’s important to ensure fairness and transparency in the reward system. Communicate clear criteria for earning gift cards and provide equal opportunities for all employees to participate. By leveraging the power of gift cards, you can inspire and motivate your employees, leading to increased productivity and a positive work environment.

Conclusion

Overall, understanding the taxation regulations surrounding gift cards in Sweden is essential for businesses and individuals. By complying with these regulations, businesses can avoid penalties and legal issues while maximizing the benefits of using gift cards as rewards and incentives. Individuals can ensure proper declaration of gift card values as taxable income and take advantage of tax benefits for charitable donations. By staying informed and seeking professional advice when needed, businesses and individuals can navigate gift card taxation in Sweden effectively and make the most of this versatile gifting option.

Let’s have a chat

FAQ

In Sweden, the sale of gift cards is subject to VAT. Companies must charge VAT at the time of purchase based on the applicable rate for the goods or services the gift card can be used for. When the gift card is redeemed, VAT is charged based on the applicable rate for the specific items or services being purchased. Accurate record-keeping is important for VAT reporting and compliance. Consulting with a tax professional or the Swedish Tax Agency is recommended to ensure proper handling of VAT considerations for gift cards.

When it comes to expiration dates, the Swedish Tax Agency does not provide specific guidelines. However, companies need to consider the overall principles of Swedish tax legislation. The income from a gift card is typically taxable in the year the card is received, regardless of whether it is redeemed before or after the expiration date.

In Sweden, gift cards carry distinct tax implications for companies and individuals. When given to employees, they’re considered taxable income, whereas, for clients, they’re deductible as business expenses. Individual tax liabilities vary based on whether the gift card resembles cash or is limited to a specific use. Staying informed about these complexities and seeking guidance from tax professionals or the Swedish Tax Agency is essential to ensure compliance and avoid unforeseen tax obligations.