The easiest way to send people gifts and rewards

It’s Free. 100 % Customizable. Available 24/7. Send to anyone – anywhere in the World.

5000+ rewards, payouts & gift cards in 170+ countries.

We are trusted and loved by thousands of companies worldwide

Instantly deliver exciting gifts & rewards

1. Sign up

2. Easy to Operate

3. Easy to Redeem

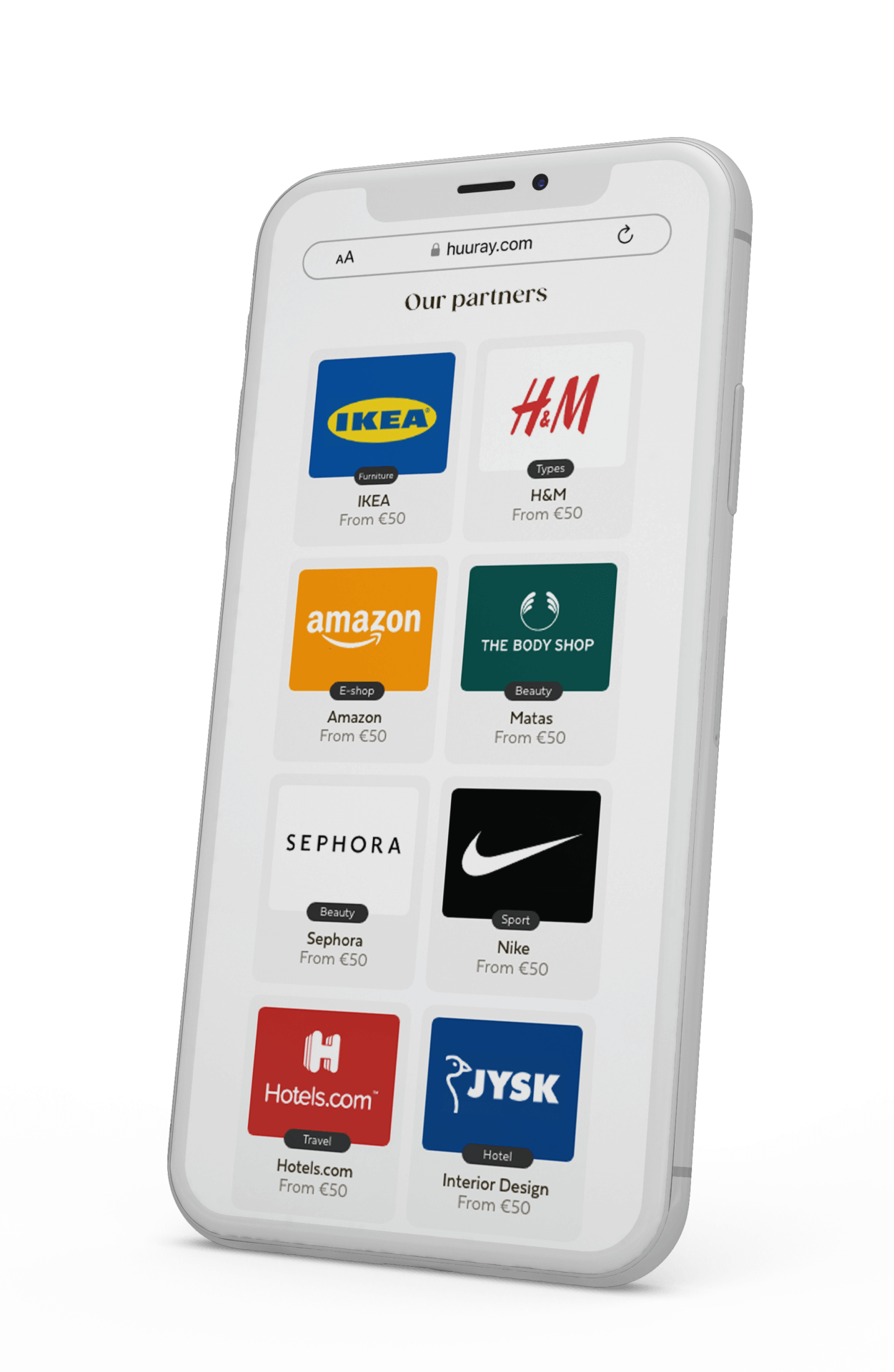

Nearly unlimited options worldwide

to choose from

Huuray gives you access to 5000+ digital rewards & gifts across 170+ countries and 80+ currencies.

These are our products

Freedom-of-Choice™ Gift Card

Empower your recipients to select from 5000+ choices within our global catalog.

Occasion Gift Cards

Choose original designs for milestones, birthdays, and holidays, or create your own design.

Create-Your-Own Gift Card

Pick a single or a range of gifts or rewards. You get to choose what options the recipients see.

You might think;

Wait. I’m in Germany.

Does this even work

in Germany?

Yep. We have digital reward options in 190+ countries around the world. Gift Cards, PrePaid Cards, Charities, and much more. Sending rewards internationally is a breeze with Huuray. All for free.

Recipients really love the rewards

In the end, it is all about the end-users. At Huuray, we make sure to keep our offer attractive and updated, to reach full satisfaction of the recipients. And we love to hear about their experiences with our gift cards from all over the world!

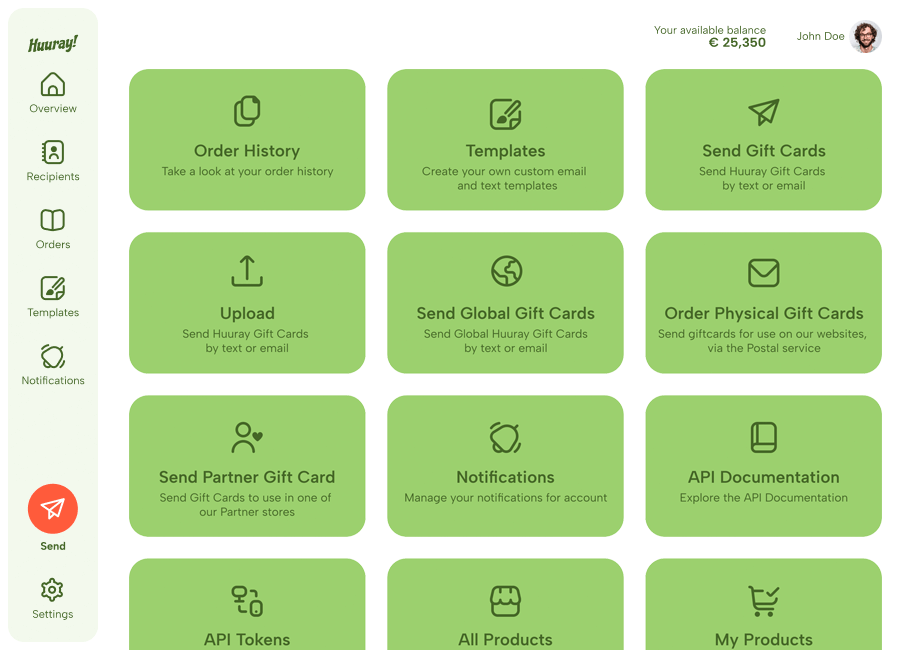

Here’s what you’re going to see

Send rewards in a few clicks. Get up and running in a few minutes, not days or weeks.

Options that recipients love

Options for your recipients We offer a market-leading catalog with more than 5,000 suppliers. You decide which stores your recipients can see. Choose from: gift cards, cash cards, multi-store gift cards, donations, subscriptions and more!!

Custom templates

Custom email templates – send personalized greetings, gift cards and rewards to suit your recipients.

Customize the size yourself

Send gift cards in bulk via email or physically. Automated rewards? We have over 100 integration partners or use our revolutionary API.

Send yourself a reward

We adapt to your needs

We needed a tool to easily pay incentives for surveys & interviews.

More stories like this one

Does it integrate with…? Yes. It does.

Get direct integration with your favorite software you already use. Huuray integrates seamlessly with all the tools in your stack.

Let’s have a chat

Gift Card, Rewards, Payouts, Consumer Incentives, and much more

Huuray is a Reward as a Service platform where you easily can distribute international gift cards, rewards, incentives, or corporate gifts. We have different options you can send throughout our platform: E-gift cards, incentive pay, crypto gift cards, donations, subscription gifts, and other payouts. Either you send it out as a bulk gift card order, or you can use our gift card API to automate the process.