Crypto for Beginners: Everything You Want to Know

Table of Contents

The way we think about money and financial transactions has been completely changed by cryptocurrency, the digital currency that has taken the globe by storm. The interest in this field is rising enormously, which can be seen in the latest innovations, such as crypto gift cards. That´s one of the factors why it is important to have a fundamental understanding of how cryptocurrency functions. We’ll cover all you need to know about crypto for beginners in this blog post. We’ll help you begin your cryptocurrency journey by guiding you through the world of cryptocurrencies, from understanding the technology that´s behind it, to the advantages it offers. So let’s explore this fascinating virtual world of currency together!

What is a cryptocurrency?

A cryptocurrency is a form of digital or virtual money that runs without the help of a central bank and uses cryptography for security. It is decentralized, which means that neither a government nor a financial institution have any influence over it. A network of computers around the world maintains a public database called a blockchain, which is used to record cryptocurrencies transactions. Thousands of cryptocurrencies are now accessible, with Bitcoin being the most well-known.

Advantages and disadvantages of cryptocurrency

Cryptocurrencies offer several potential advantages and disadvantages that you should consider before deciding to invest or use them. Here are some of the main advantages and disadvantages of using cryptocurrency:

Advantages of cryptocurrency

Decentralization: Cryptocurrencies run on a decentralized network, which means they aren’t regulated or managed by a single institution. This reduces their vulnerability to censorship or manipulation by governments or financial organizations. Users may benefit from greater security and anonymity thanks to decentralization because there is no single point of failure or control.

Transparency: Transactions on the blockchain are openly visible and transparent, which can offer a high level of accountability. Since all transactions are documented and made public, this may assist in the prevention of fraud and other unlawful activities.

Security: Cryptocurrencies use cryptography to secure transactions, which makes them difficult to forge or hack. Users may feel more secure as a result because advanced algorithms for cryptography are used to protect their interactions.

Accessibility: Cryptocurrencies can be more accessible than conventional financial systems because they are available to everyone with an internet connection. For those without access to conventional financial systems, such as those living in underbanked communities or developing nations, this can be especially helpful.

Lower transaction costs: Generally speaking, cryptocurrency transaction costs are lower than those of conventional financial systems, particularly for international transactions. As a result, they may be a more affordable choice for those who want to transfer money abroad or conduct small transactions.

Disadvantages of cryptocurrency

Volatility: The value of cryptocurrencies can fluctuate significantly in a brief amount of time, making them potentially risky investments. As a result, they may be a risky investment because buyers may not be able to anticipate or manage these price fluctuations.

Complexity: For many users, cryptocurrencies can be complicated and challenging to understand, which makes them less approachable and more intimidating. Because of this, it may be challenging for some people to use and invest in cryptocurrencies, particularly if they are unfamiliar with technology or finance.

Lack of acceptance: Despite an increase in the number of businesses taking cryptocurrencies, this method of payment is still not widely used. Because users might not be able to use cryptocurrencies to pay for goods and services, they may find it challenging to use them in their everyday lives.

How to start with cryptocurrency?

Cryptocurrency has become a popular investment option in recent years. The decentralized nature of this currency has piqued the interest of many investors. Starting out in the cryptocurrency industry can be intimidating if you’re new to it. However, with a little guidance, you can easily dive into this exciting world and start making profit easily.

You can start using cryptocurrencies by following these advice:

1.Research before investing: Take the time to look into and understand the industry before investing any of your hard-earned money in cryptocurrencies. You can find a ton of information on the many kinds of cryptocurrencies, their history, and the advantages and disadvantages of investing in them online.

2. Choose a reliable exchange: You’ll need a cryptocurrency exchange to buy and sell digital currencies. Choose an exchange that has a good reputation and is regulated by the relevant authorities. Look for an exchange that supports the cryptocurrency you’re interested in investing in.

3. Create a wallet: A cryptocurrency wallet is a digital wallet that stores your digital currencies. You can choose from software or hardware wallets, depending on your preference. A software wallet is more convenient, but a hardware wallet is more secure.

4. Start little and gradually grow your investment. As with any investment, it’s ideal to start modest and increase your commitment over time. This allows you to get comfortable with the process and assess the risks involved.

5. Diversify your portfolio: Don’t put all your money into one type of cryptocurrency. Diversify your portfolio by investing indifferent cryptocurrencies to spread your risk. To further diversify your investment portfolio, you may also think about investing in several asset types like stocks and bonds.

By following these tips, you can start your cryptocurrency journey with confidence. Remember to stay informed and stay cautious. Crypto is a fast-evolving field, and there are risks involved. However, with careful research and a diversified portfolio, investing in cryptocurrencies can be a fruitful and exciting experience.

Crypto for beginners: More than just a Bitcoin

Cryptocurrencies have been gaining popularity over the years, and there are currently over 5,000 different types available. However, not all of them are as popular or widely accepted as others. Here are the main types of cryptocurrencies available:

- Bitcoin (BTC): The most popular and well-known cryptocurrency, was developed in 2009. Bitcoin has the biggest market value and has been widely used as a method of payment for goods and services, but also as an trading tool. It operates on a decentralized network of computers, with no central authority or institution controlling its transactions.

- Ethereum (ETH): Ethereum, which was introduced in 2015, is currently the second-largest cryptocurrency by market value. It is a decentralized system for developing independent programs and smart contracts (DApps).

- Litecoin (LTC): A 2011 invention, Litecoin is commonly referred to as the “silver to Bitcoin’s gold.” Compared to Bitcoin, it is a peer-to-peer digital currency that is more lightweight, faster, and cheaper to use and trade.

- Tether (USDT) is a currency that has been linked to the US dollar’s worth. Tether is a cryptocurrency that is connected to the US dollar, making it less vulnerable to price fluctuations and more suitable for use as a means of exchange or more stable store of value than conventional currencies. In cryptocurrency exchanges, it is frequently used as a means of reducing volatility.

- Cardano (ADA): Cardano is special because it was developed using a scientific methodology that placed a high priority on peer-reviewed study and evidence-based development. One of Cardano’s main goals is to offer a platform that is safer, more open, and easier to use for developing decentralized apps (dApps) and smart contracts. It seeks to address some of the sustainability, interoperability, and scalability problems linked to other blockchain platforms.

The most common kinds of cryptocurrencies are represented by these few examples. Before making an investment in any of them, it’s essential to conduct your own research into their individual features and use cases. Never invest more than you can afford to lose, and always be educated and cautious. Investing in cryptocurrencies can be a rewarding experience that creates new possibilities for your financial future if you have the proper attitude and strategy.

Crypto wallet: A way to store your cryptocurrencies safely

Digital currencies like Bitcoin, Ethereum, and Litecoin are becoming increasingly well-known in the modern world. The demand for a safe place to keep these currencies has increased as more and more people start investing in them. This is where cryptocurrency wallets come into play.

So, what is a cryptocurrency wallet, and how does it differ from a regular wallet?

A cryptocurrency wallet is a digital wallet that stores your private and public keys, allowing you to send and receive digital currencies. Imagine it as a virtual bank account where you keep your digital currency. As long as you have an internet connection, you can access your money from anywhere around the world.

A traditional wallet, on the other hand, is a physical case that you use to hold your cash and credit cards. Typically, it takes the form of a billfold that slips in your pocket and is made of leather or fabric. A regular wallet, as opposed to a cryptocurrency wallet, is used to hold real cash and credit and debit cards rather than digital currencies.

One of the main differences between a cryptocurrency wallet and a regular wallet is the level of security they provide. All of your cash and credit cards are gone if your regular wallet is lost or stolen. A cryptocurrency wallet is much more safe than a traditional wallet because you need a private key to access your money with it.

Additionally, cryptocurrency wallets are made to be anonymous, so your activities are not associated with any of your personal data. Because of this, it is much more difficult for hackers to steal your money or access your confidential information. In contrast, the likelihood of identity theft increases when a regular wallet is used because it frequently includes personal information, like your ID or driver’s license.

What happens if you don’t report cryptocurrencies on taxes?

The tax authorities may fine and penalize you if you fail to disclose your cryptocurrency on your taxes. Depending on where you live and the specific laws in your state, the exact penalties will change, but in general, neglecting to report your cryptocurrencies may result in fines, interest charges, and in some cases, even criminal charges.

For instance, the Internal Revenue Service (IRS) in the US sees cryptocurrencies as property, making them liable to the same tax regulations as other types of property. This implies that you might be required to pay capital gains tax on any profits made if you purchase or sell cryptocurrency. Furthermore, if you use cryptocurrency to pay for products or services, you must declare the cryptocurrency’s fair market value as earnings on your tax return.

Remember that tax laws relating to cryptocurrencies can be complicated and prone to change, so it’s always a good idea to speak with a tax expert if you have any concerns or questions about your tax obligations relating to cryptocurrencies.

Here you can read more about taxes on crypto.

How do I purchase cryptocurrency?

If you are considering buying cryptocurrencies, you are at the right place. While the process may seem daunting at first, it is actually very simple.

Here is a simple way onto how to purchase crypto:

- 1. Choose a cryptocurrency exchange: There are several cryptocurrency exchanges available such as Coinbase, Binance, Kraken, and others.

- 2. Create an account: Once you have chosen an exchange, create an account by providing your details such as name, email address, and phone number. You may also need to verify your identity by providing a valid government-issued ID.

- 3. Add funds to your account: To buy cryptocurrency, you need to add funds to your exchange account. You can do this by linking your bank account or credit card to your exchange account.

- 4. Choose the cryptocurrency you want to buy: Different exchanges offer different cryptocurrencies. Choose the one you want to buy and check its current market value.

- 5. Buy the cryptocurrency: Once you have added funds to your account and selected the cryptocurrency, you can buy it by placing an order. You can either place a market order or a limit order.

- 6. Store your cryptocurrencies: After purchasing the cryptocurrency, you need to store it in a digital wallet.

Turn crypto into a gift: Purchase crypto gift card

With the quick approach of innovations and including crypto into our everyday life, crypto gifts became also a popular topic. A quick and easy method to introduce someone to the world of virtual currency is to buy them a gift card. A cryptocurrency gift card makes it simple to purchase and send digital currency as a gift, giving the recipient an easy way to start using cryptocurrencies without having to go through the occasionally difficult process of setting up a digital wallet and buying cryptocurrencies.

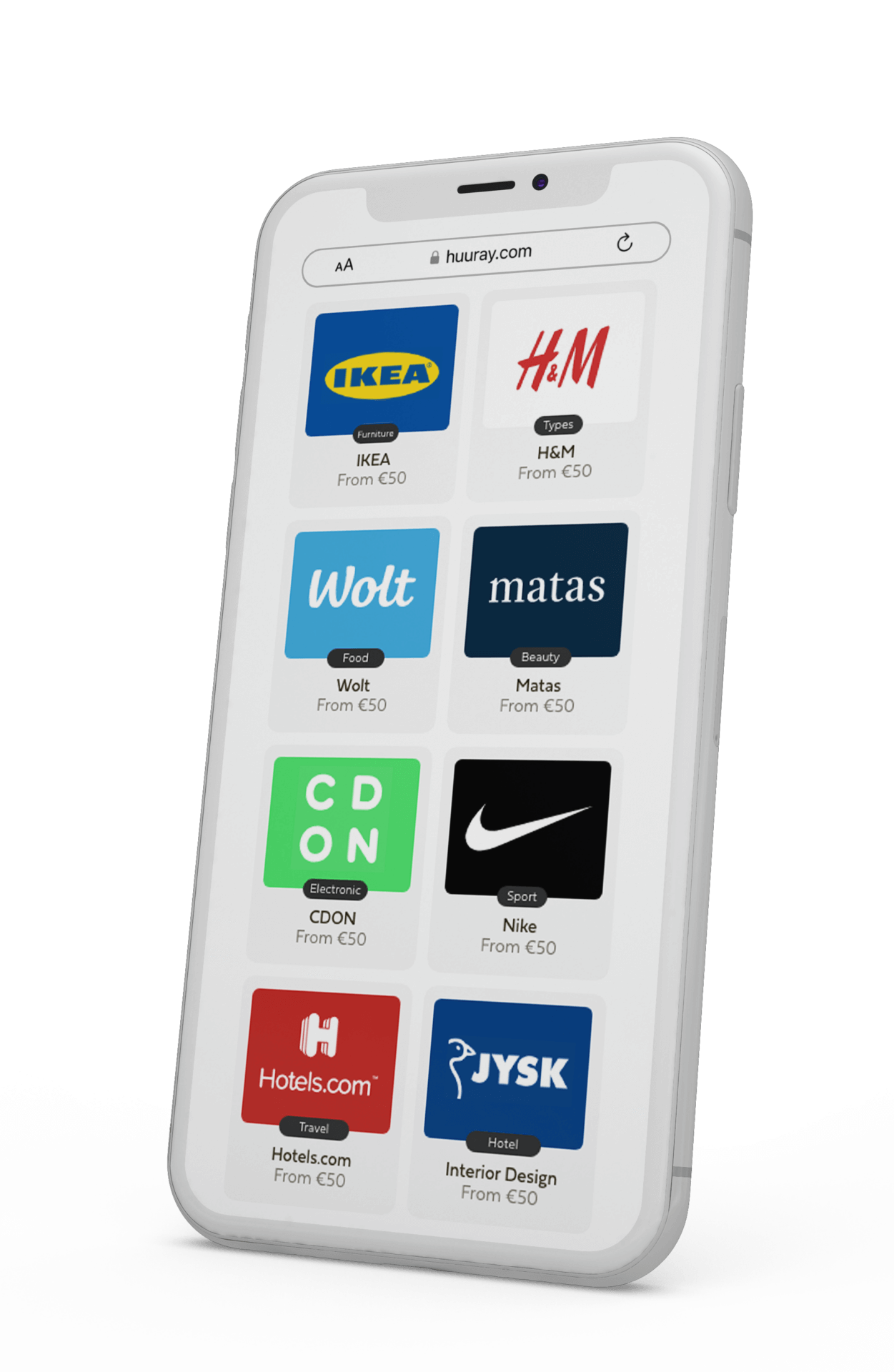

This might be especially convenient solution for businesses who are looking for innovative payouts for their employees. With Huuray, you can easily purchase a crypto gift card like BitCard or Azte.co, which allows the recipients to easily exchange the value of the card into cryptocurrency. What more, Huuray allows you to create bulk gift cards order, which saves your time and money.

Want to see how Huuray´s gift cards arrive?