Gift Card Tax in Denmark: What Companies Need to Know

By Kevin Cheung February 12, 2024

Gift card tax in Denmark can be complex and requires careful attention to regulations and reporting requirements. Companies using gift cards as rewards or incentives should be aware of the tax implications and take necessary steps to ensure compliance.

Jump to section

Gift Card Tax in Denmark

Gift card tax in Denmark is an important aspect that companies need to understand and comply with. In Denmark, any gift exceeding 1300 DKK is subject to taxation, regardless of whether it is a christmas gift card or any other type of gift. This annual limit of 1300 DKK applies to all gifts. It is important for companies to be aware of this threshold and ensure compliance with the gift card tax regulations in Denmark. By understanding and adhering to these regulations, companies can avoid potential penalties of fine payment and ensure proper reporting of gift card taxes. In Denmark, cash gifts are always subject to taxation, regardless of the amount and also when it comes to gift cards that can be transfered to cash, digital gift cards or gift card with wide range of applications it should also be taxed.

What is SKAT?

In Denmark, SKAT also called Skattestyrelsen is the central authority responsible for collecting taxes and duties and administering tax regulations. SKAT’s main tasks include:

1. Collection of taxes and duties

SKAT is responsible for collecting various types of taxes and duties. These include income tax, which is based on taxable income, VAT, which is imposed on goods and services, and property tax, which is collected from property owners. In Denmark, the tax deduction rate can vary from 38% to 53% depending on whether you pay top or bottom tax. In addition to these, there are other public taxes that are also administered by SKAT.

2. Registration and control of businesses and citizens

One of SKAT’s most important tasks is to manage the registration of both businesses and individuals and ensure that they fulfill their tax obligations under the law. This involves ensuring that all businesses and citizens are properly registered and monitoring their tax activities to ensure compliance with the law.

3. Advice and guidance

SKAT provides guidance and advice to citizens and businesses on various tax rules and procedures. This can include guidance on how to fill out tax forms correctly, what deductions and tax benefits are available, and how to correctly report income and expenses.

4. Issuing tax statements and refunding excess tax

After submitting tax information, SKAT processes this information and issues tax statements to taxpayers. If there is an excess tax, SKAT pays this to the taxpayer. This can be done either as a direct transfer to a bank account or by issuing a tax check.

5. Fighting tax evasion and fraud

SKAT works actively to combat tax evasion, tax fraud and tax avoidance. This includes implementing control measures such as audits and inspections to ensure that taxpayers comply with the law. In addition, SKAT often collaborates with other authorities, including the police and law enforcement agencies, to pursue cases of tax evasion and fraud.

If you have any questions or are you unsure about something, you should contact SKAT

Send yourself a gift card

Taxation for Employees and Employers

What to do as employees:

As employees you must declare the amount on your annual tax return if you at any time receive gifts from an employer where the total value exceeds 1,300 DKK in 2024. If the value of the gifts exceeds DKK 1,300, the entire value of the gift is taxable and therefore must be reported.

Example: You receive a gift worth 400 DKK from one employer and another gift worth 1000 DKK from another employer. The total value of the gifts is 1,400 DKK As the amount is now above the limit of 1,300 DKK, you must state the total value of the gifts on your annual statement in box 20.

What to do as employers:

If the gift, whether it is in the form of a taxable gift card, cash or if the value of the gift itself exceeds DKK 1,300 in 2024, you must report the value of the gift to SKAT. You also have the option to include the cost of the gift in your company’s tax accounts.

Related: Gift Card tax in Norway

A list of gift cards that are always taxable:

- Gift cards that can be exchanged for cash

- Digital gift cards, e.g. plastic cards

- Gift cards with a wide range of uses

- Experience gift cards

There are three kids of giftcards that are always tax free:

- The gift voucher is only valid for a few selected gifts from an online provider.

- The employer has pre-selected the gift on the gift voucher for each employee.

- The gift card is a gift certificate to a specific named restaurant, where it can only be used for the three-course menu of the day or for one of 3 three-course menus created by the employer

If a gift card is not tax-free, it must be reported as taxable (A-income).

Let’s have a chat

The difference between A and B income

“A-income” and “B-income” are two different types of income used in Denmark to calculate taxes and duties. Gift cards and gifts as employee incentives are in some situation a type of income. Here are the differences between them:

A-income:

- A-income includes income from employment with an employer, including salary, bonuses, commissions and benefits in kind.

- This type of income is usually pre-reported to SKAT by the employer, making it easier for the taxpayer to report and for SKAT to verify.

- Taxes and duties on A-income are usually withheld directly by the employer and reported to SKAT via the payroll system.

B-income:

- B-income covers income that is not covered by A-income, such as income from self-employment, freelance fees, rental income, capital income (e.g. interest income, dividends) and other forms of non-salaried income.

- The taxpayer is usually responsible for reporting and paying taxes and duties on B-income to SKAT.

- B income can be more complex to report as it is not pre-reported and the taxpayer must take care of calculating and reporting the income correctly.

Tax Rules for Christmas Presents:

If the total amount exceeds 1300 DKK as it does here, it is taxable.

Even though this amount exceeds 1300 DKK, the Christmas gift is tax free as this gift does not exceed the Christmas gift limit of 900 DKK. The other gift of 500 is still taxable.

Why are gift card taxation laws important?

Gift card taxation laws serve important purposes and fulfill multiple crucial objectives:

- Revenue Collection: Taxation on gift cards ensures that the government collects revenue on economic transactions, even those involving gifts. This revenue contributes to funding public services and welfare programs.

- Fairness and Equality: By taxing gift cards, the government ensures fairness and equality in the tax system. All forms of income, including gifts, are subject to taxation, which helps distribute the tax burden more evenly across the population.

- Prevention of Tax Evasion: Clear taxation laws on gift cards help prevent tax evasion. Without proper regulations, individuals and businesses might exploit gift cards as a way to avoid paying taxes on income.

- Transparency and Compliance: Taxation laws provide transparency and encourage compliance with tax regulations. Clear guidelines on how gift cards are taxed help individuals and businesses understand their tax obligations and ensure they comply with the law.

- Consumer Protection: Taxation laws can also provide consumer protection by ensuring that gift card issuers and recipients are aware of their tax implications. This transparency helps prevent misunderstandings and disputes related to tax liabilities on gift cards.

Employers Responsability when providing gift card to employees in Denmark

These are nice to know facts for employer when providing gift cards to employees:

- Tax obligations: Gift cards to employees are often considered salary and are therefore subject to tax obligations. This means that the value of the gift card is usually taxed as personal income for the employee.

- Deductibility for the company: Expenses for gift cards to employees can usually be deducted as operating costs in the company’s tax accounts. However, it is important to ensure that the gift card meets the requirements for tax deductions according to legislation.

- Limits and tax exemption: There are often limits on how much an employee can receive tax-free as a gift. It’s a good idea to check the current rules and limits for tax-free gifts to employees.

- Tax treatment of the value of the gift card: The value of the gift card is usually considered salary and therefore tax and labor market contributions must be deducted from the amount. This can be handled either by withholding tax and contributions from the value of the gift card or by reporting the value of the gift card as salary income.

- Administration and documentation: It is important to ensure proper administration and documentation of gift cards to employees to fulfill tax requirements and ensure that the company complies with legislation.

Related: Gift Card taxation in Sweden

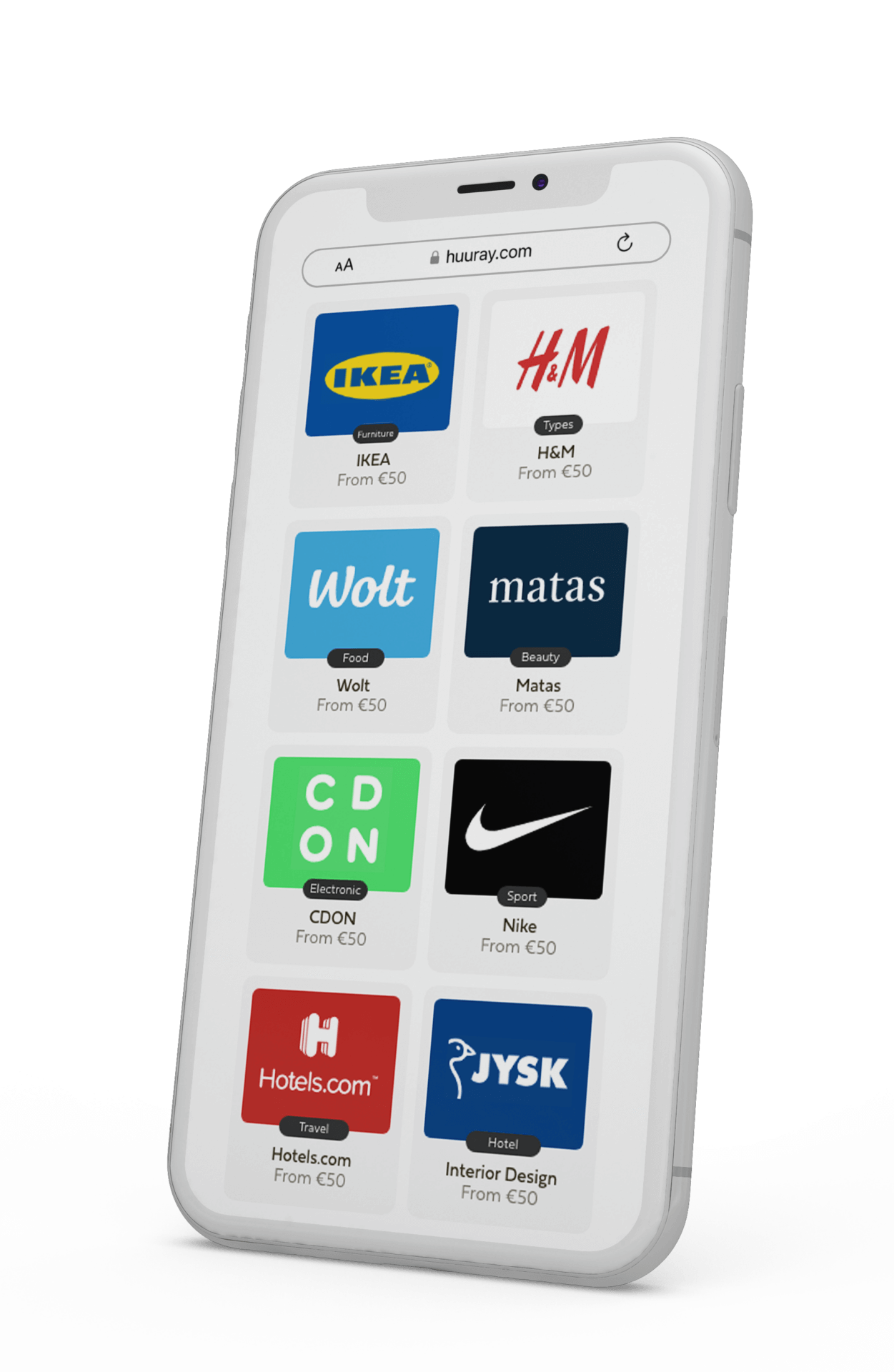

Types of gift cards in Denmark

Luksus gavekortet

Luksus Gavekortet offers the recipient the ultimate decision to choose whatever gift you are looking for and to purchase it. With this multi-purpose gift card, you can choose your gift between more than 1,000 stores all over in Denmark.

Restaurants and bars

This gift cards offers a wide selection of many Restaurants & Bars all over Denmark. Taste different kind of food from other cultures.

Entertainment Gift Card

Entertainment gift cards may be used to access entertainment services, such as streaming subscriptions, cinema tickets, or events. They provide access to a wide range of entertainment options.

Create your own giftcards

We allow costumers to personalize your own gift cards with custom designs, colors, images and messages. This gift card is often used in special occasions.

You can find a wide selection of tax free gift cards to many other experiences.

Common Tax Mistakes to Avoid

Failure to track and report gift card sales:

Companies must accurately track and report the sales of gift cards as taxable income. Failing to do so can result in underreporting and potential penalties.

Incorrect valuation of gift cards:

Gift cards should be valued at their face value for tax purposes. Using an incorrect valuation method can lead to inaccurate tax calculations and potential compliance issues.

Neglecting to account for expiration dates:

In Denmark, gift cards with expiration dates are subject to tax regardless of whether they are redeemed or not. Companies should ensure they account for the tax implications of expired gift cards.

Inadequate record-keeping:

Proper record-keeping is essential for gift card tax compliance. Companies should maintain detailed records of gift card sales, redemptions, and any associated tax liabilities.

Ignoring reporting and filing requirements:

Companies must fulfill reporting and filing requirements related to gift card tax. Neglecting these obligations can result in penalties and audits.

Lack of awareness of specific regulations:

Gift card tax regulations may vary depending on the jurisdiction. Companies should stay informed about the specific regulations in Denmark to ensure compliance.

Related: Gift Card taxation in Finland

Case Studies: Examples of how taxation works in Denmark

Case Study 1: Christmas gift from the company

Anna works as an accountant in an accounting firm. At Christmas time, the company decides to give all employees a DKK 1,500 gift card to a local restaurant as a Christmas present. As Christmas gifts have a limit of DKK 900 before tax is due, it is taxable for Anna as salary income. She therefore has to pay tax and labor market contribution on the value of the gift card.

Case Study 2: Birthday gift from the company

Henrik works as an IT consultant in an IT company. On his birthday, he receives a DKK 1,200 gift card to an electronics store from the company as a birthday present. As the gift card has a value below the threshold of 1300 DKK, it is tax-free for Henrik and he does not have to pay tax on the value of the gift card.

Case Study 3: Birthday gift from the company

Peter has worked hard on a project and delivered an extraordinary effort. In recognition, the company decides to reward him with a gift card of DKK 2,500 to a wellness clinic. As the gift card is a reward for Peter’s extraordinary work effort, it is considered earned income and is therefore taxable for him.

Case Study 4: Anniversary gift from the company

Louise has been working for a company for 10 years. As a celebration of her anniversary, the company decides to give her a gift card of DKK 3,000 to a luxury restaurant. As this gift card is considered an anniversary gift and not a reward for work performance, it may be tax-free for Louise if it falls within the relevant tax rules for anniversary gifts.

Conclusion

In conclusion, understanding and managing gift card tax in Denmark is crucial for companies using gift cards as rewards or incentives. By being aware of the tax implications, following regulations, and implementing effective strategies, companies can minimize tax liabilities, ensure compliance, and streamline their operations. It is important to track and report gift card sales accurately, value gift cards correctly, account for expiration dates, maintain proper record-keeping, fulfill reporting requirements, and stay informed about specific regulations. By avoiding common tax mistakes and seeking professional advice when needed, companies can navigate gift card tax regulations successfully and contribute to a fair and transparent tax system in Denmark.

Let’s have a chat

FAQ

Companies can manage gift card tax by implementing strategies such as structuring gift card programs, tracking tax liabilities, and optimizing tax benefits. Seeking professional advice can also be beneficial.

Please note that this FAQ provides general information and it is recommended to consult with tax professionals for specific guidance related to individual circumstances.

Non-compliance with gift card tax regulations can result in penalties, fines, or audits. It is crucial for companies to stay informed and fulfill reporting and compliance requirements.

There are no specific exemptions or deductions for gift card tax in Denmark. However, companies can optimize tax benefits by structuring gift card programs and seeking professional advice.

Companies should accurately track and report gift card sales as taxable income, ensuring compliance with tax regulations.

Gift cards that can be exchanged for cash, digital gift cards, gift cards with a wide range of uses, and experience gift cards are always taxable in Denmark.

No, not all gift cards are taxable in Denmark. However, any gift exceeding 1300 Danish kroner is subject to taxation.